Small businesses are increasingly turning to cloud-based solutions to manage their payroll efficiently and effectively. Cloud-based payroll software not only simplifies the payroll process but also ensures business compliance with ever-changing tax laws and regulations.

Here, we explore six of the best online cloud-based payroll software options in the UK, tailored to meet the needs of small businesses and startups.

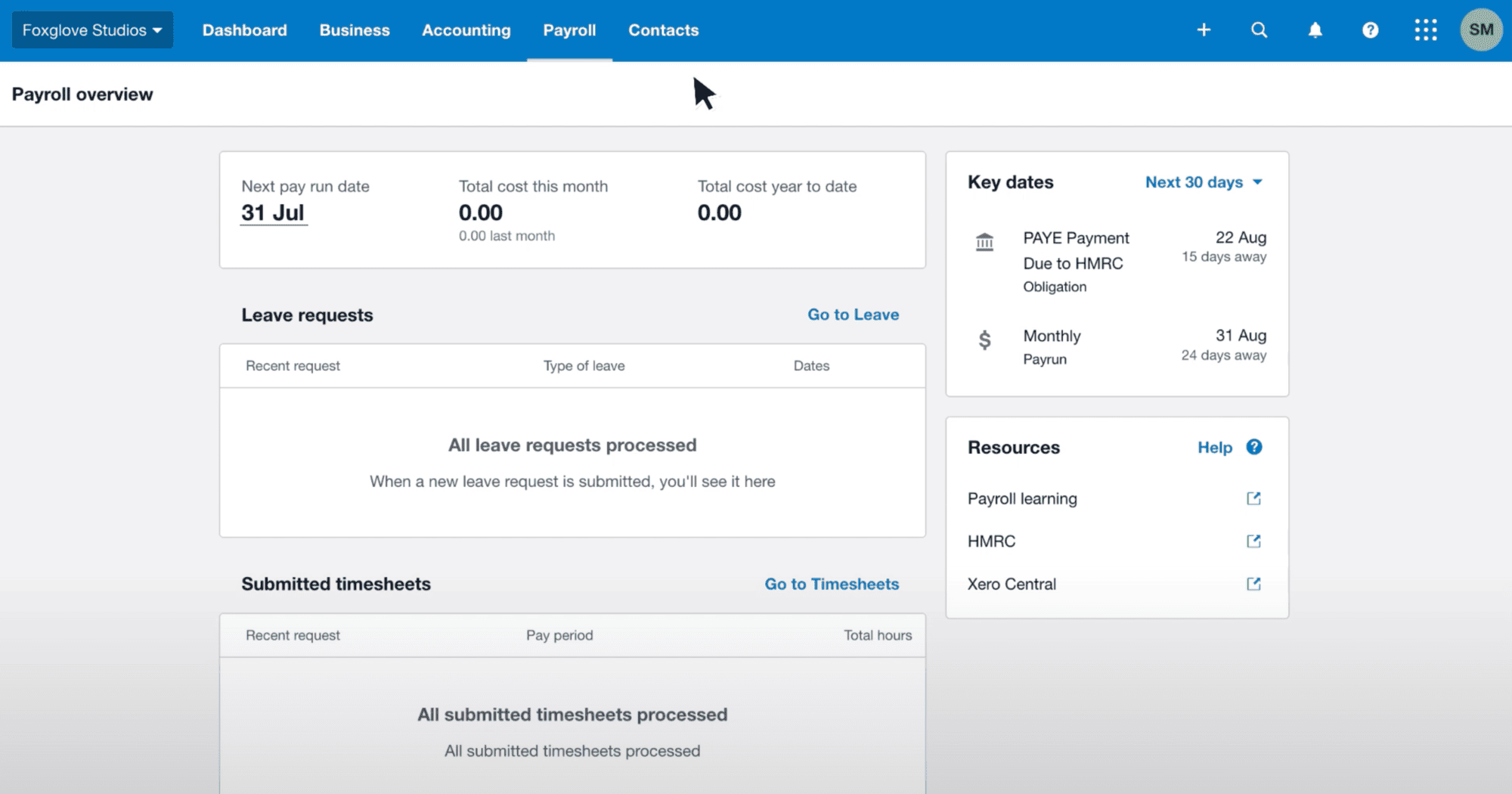

1. Xero Payroll

Xero is well-known for its user-friendly accounting software, and its payroll module is no exception. Xero Payroll integrates seamlessly with the main Xero accounting platform, providing a comprehensive solution for managing finances and payroll in one place. Key features include automatic tax calculations, real-time updates to comply with HMRC requirements, and the ability to submit Real Time Information (RTI) directly.

Additionally, employees can access payslips and submit leave requests through the mobile app, enhancing the overall user experience.

Prices

Xero offers several subscription tiers, which include payroll features. The standard plan starts at £26 per month, which includes payroll for up to 5 people. Higher plans support more employees and add additional features.

Best suited for?

Xero Payroll is ideal for small businesses already using Xero for accounting and looking for a seamless integration between their accounting and payroll processes. It’s particularly beneficial for businesses that value a strong mobile presence for their employees to manage payslips and leave requests.

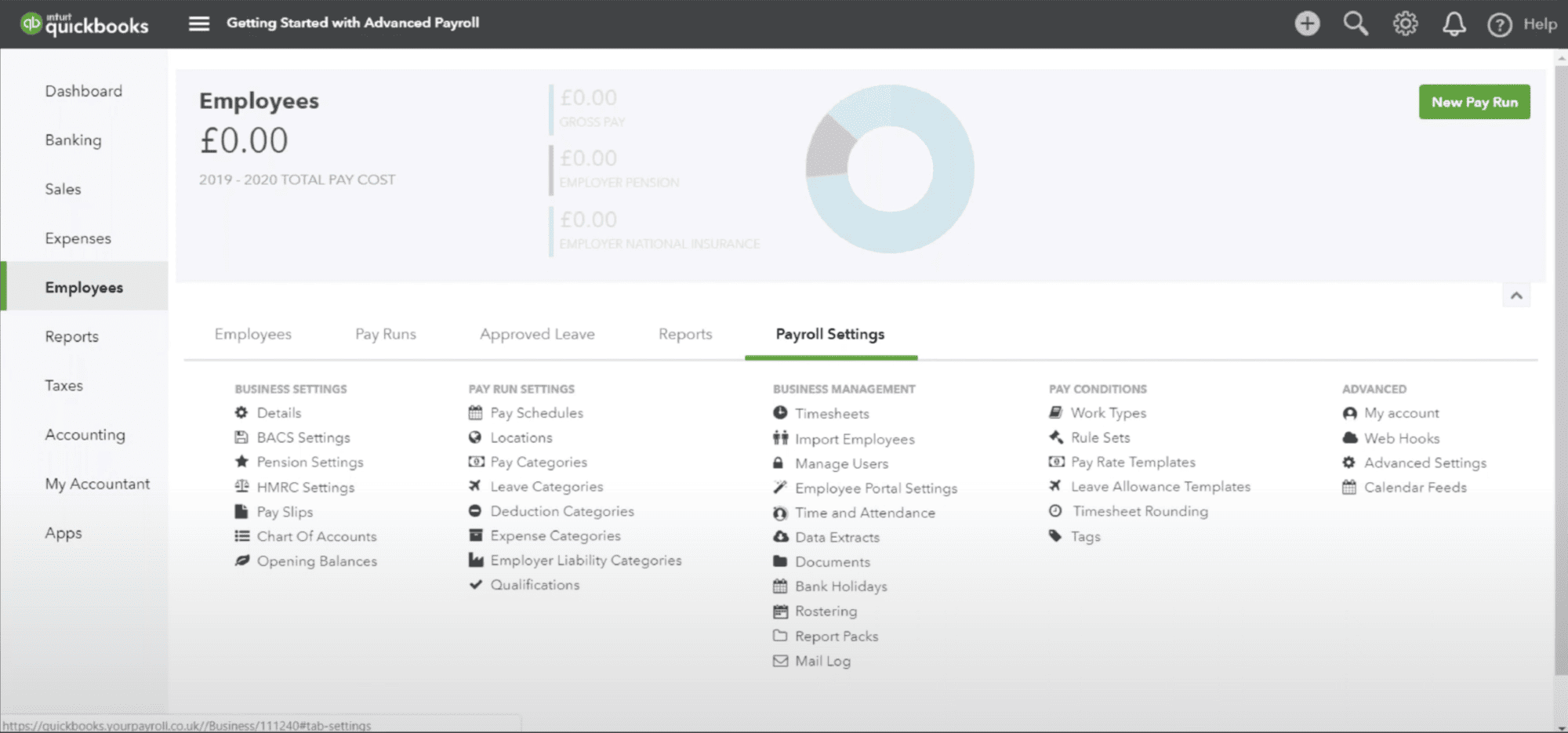

2. QuickBooks Online Payroll

QuickBooks Online Payroll offers a robust payroll solution that integrates seamlessly with its accounting software. It is designed to simplify the payroll process, with features such as automatic payroll runs, pension auto-enrolment, and integrated time tracking. This software also updates payroll calculations automatically, ensuring compliance with current UK tax laws. The intuitive interface makes it easy for small business owners to navigate and manage their payroll obligations without needing extensive accounting knowledge.

Prices

QuickBooks Online Payroll is available as an add-on to any QuickBooks Online plan. Prices start at around £8 per month as an add-on, with the first few months often discounted depending on promotional offers.

Best suited for?

This software is best suited for small businesses that are looking for an all-in-one solution for accounting and payroll. It’s particularly useful for those who require detailed reporting and real-time data syncing across financial operations.

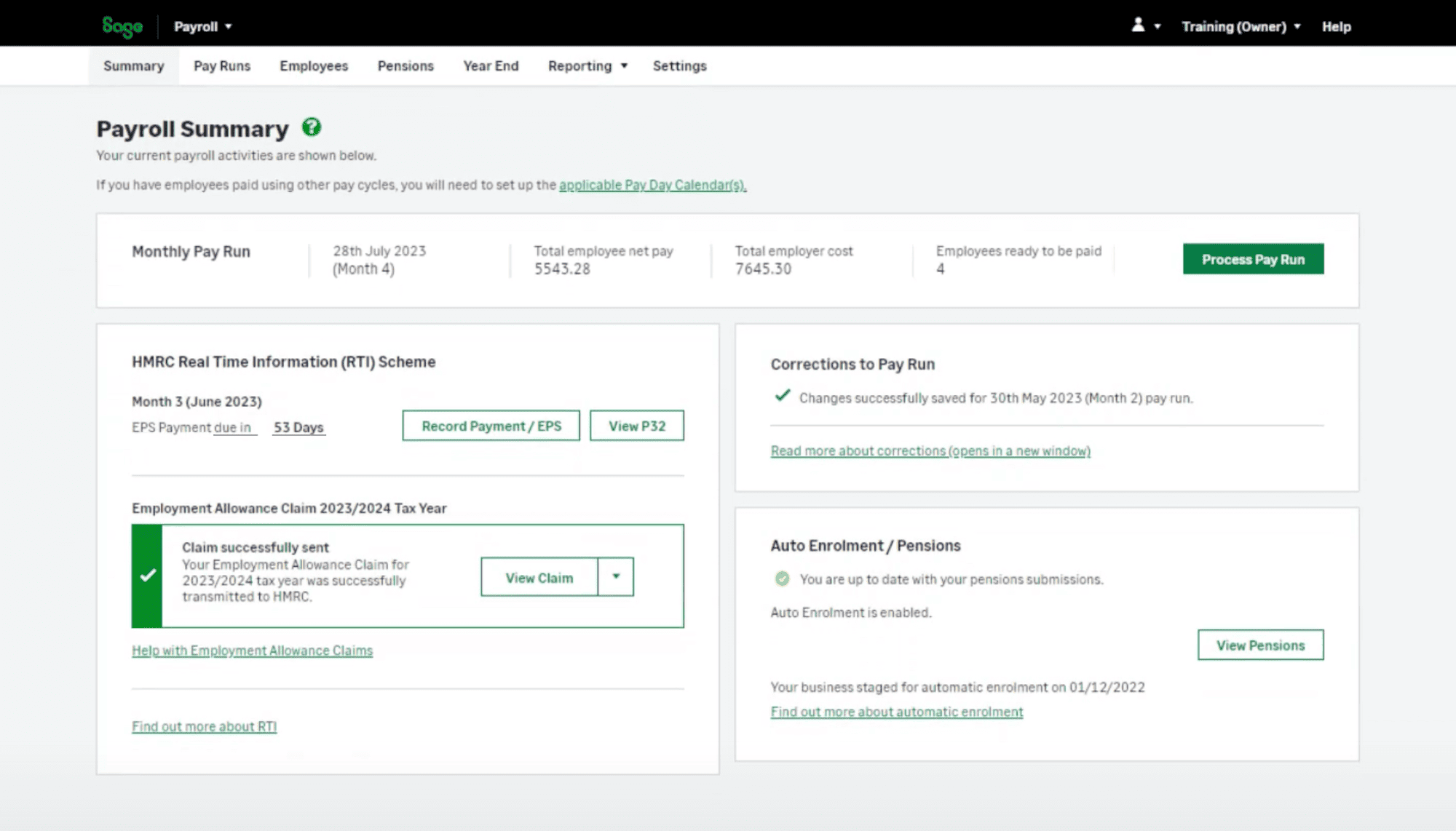

3. Sage Business Cloud Payroll

Sage has long been a staple in the accounting and payroll software industry. Sage Business Cloud Payroll is specifically designed for small to medium-sized businesses, offering scalability as your business grows. It features a simple step-by-step process for payroll processing and includes automatic updates to remain compliant with UK tax legislation. Sage also provides detailed reports to help manage payroll costs effectively, making it a popular choice for businesses seeking comprehensive payroll solutions.

Prices

Sage Business Cloud Payroll pricing starts from £7 per month for up to 5 employees, with the price increasing with more employees. This makes it a scalable option for growing businesses.

Best suited for?

Sage is suitable for businesses that need a robust payroll solution that can grow with their business. It’s ideal for those who also require detailed insights and reporting on payroll expenses and prefer a provider with a long-standing reputation in the market.

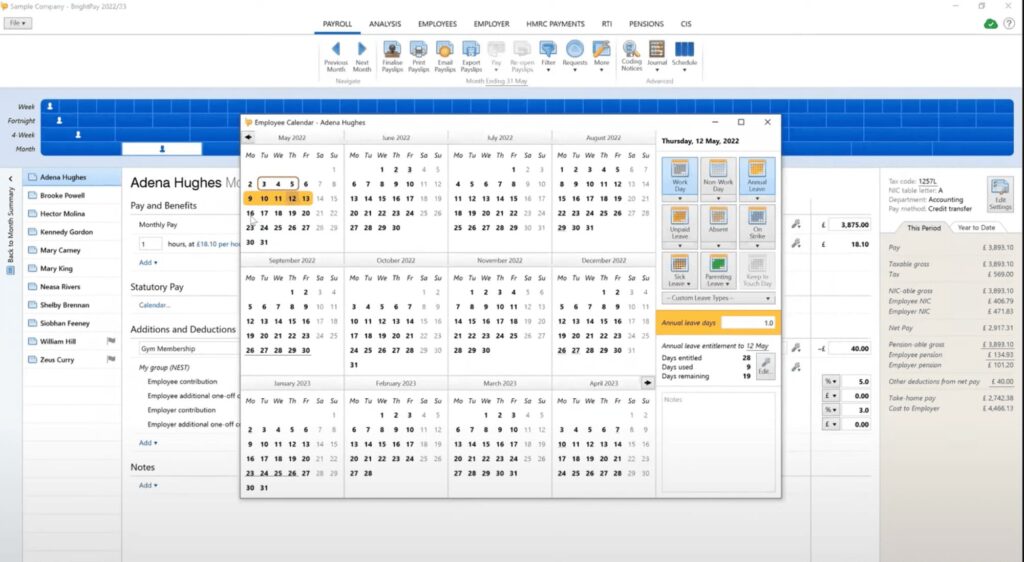

4. BrightPay

BrightPay is known for its versatility and user-friendly interface. It supports unlimited employees and employers, making it ideal for growing businesses. One of the standout features of BrightPay is its strong focus on security, with regular backups and encryption to protect sensitive data. The software includes functionalities for RTI submissions, automatic enrolment for pensions, and a bespoke module for managing furlough payments, which was particularly useful during the COVID-19 pandemic.

Prices

BrightPay’s pricing is based on the number of employees and the level of functionality required. The standard version starts at approximately £149 per year for up to three employees.

Best suited for?

BrightPay is best suited for small businesses that place high importance on security and data protection. It’s also ideal for those who need flexible payroll processing capabilities, such as handling different types of employee contracts and varying payment schedules.

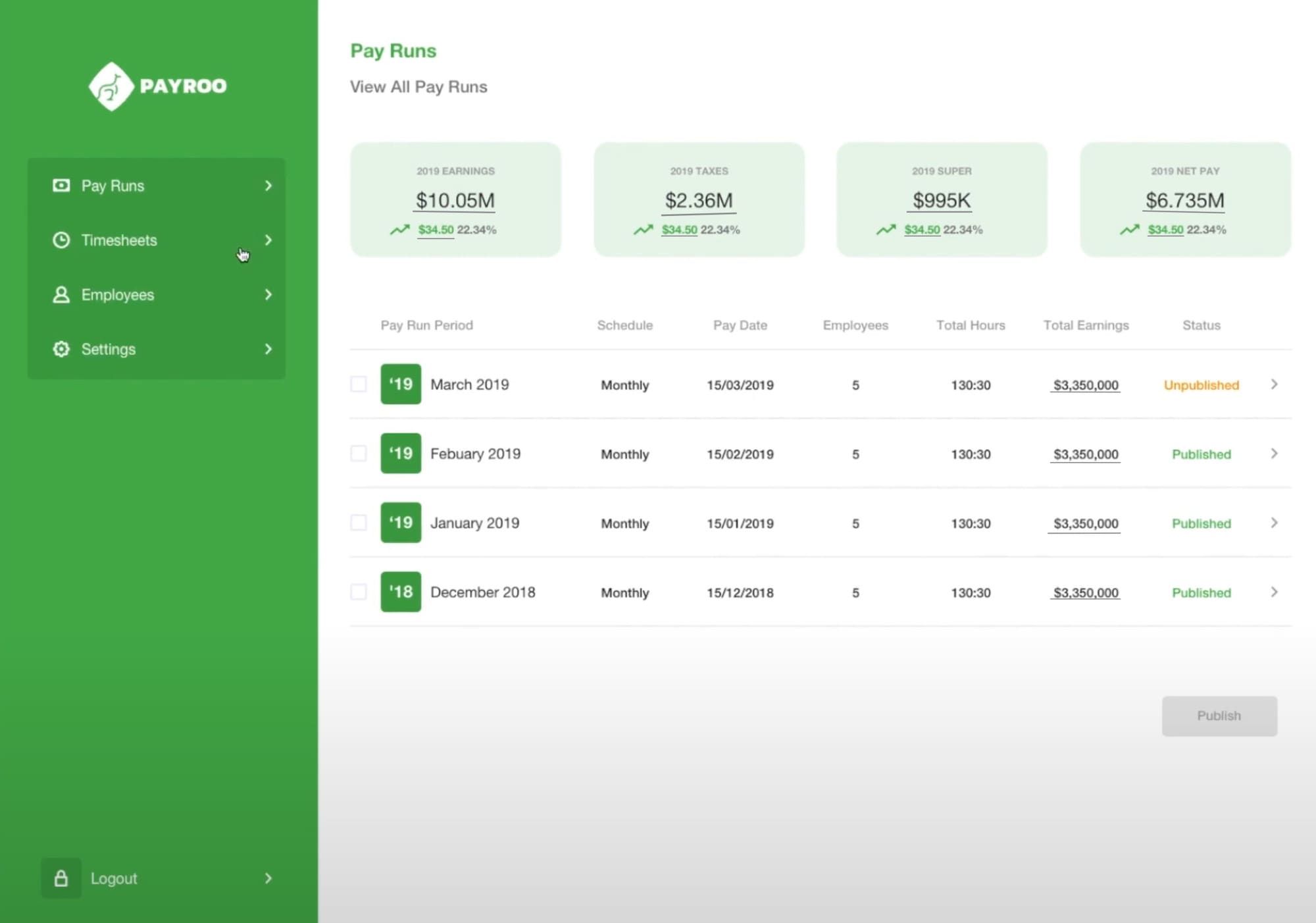

5. Payroo

Payroo offers a straightforward, HMRC-recognised payroll solution that is well-suited for small businesses looking for a cost-effective option. It provides features such as RTI submissions, automatic pension contributions, and a self-service portal for employees. Payroo also stands out for its commitment to transparency, with no hidden fees and a clear pricing structure. Additionally, it offers a free tier, which can be particularly attractive for startups and very small businesses.

Prices

Payroo offers a free tier for companies with fewer than 10 employees, making it a highly affordable option. For more employees, pricing starts at £1 per employee per month.

Best suited for?

Payroo is particularly well-suited for startups and very small businesses that are looking for a straightforward, cost-effective payroll solution. It’s also ideal for companies that appreciate a pricing structure without hidden fees.

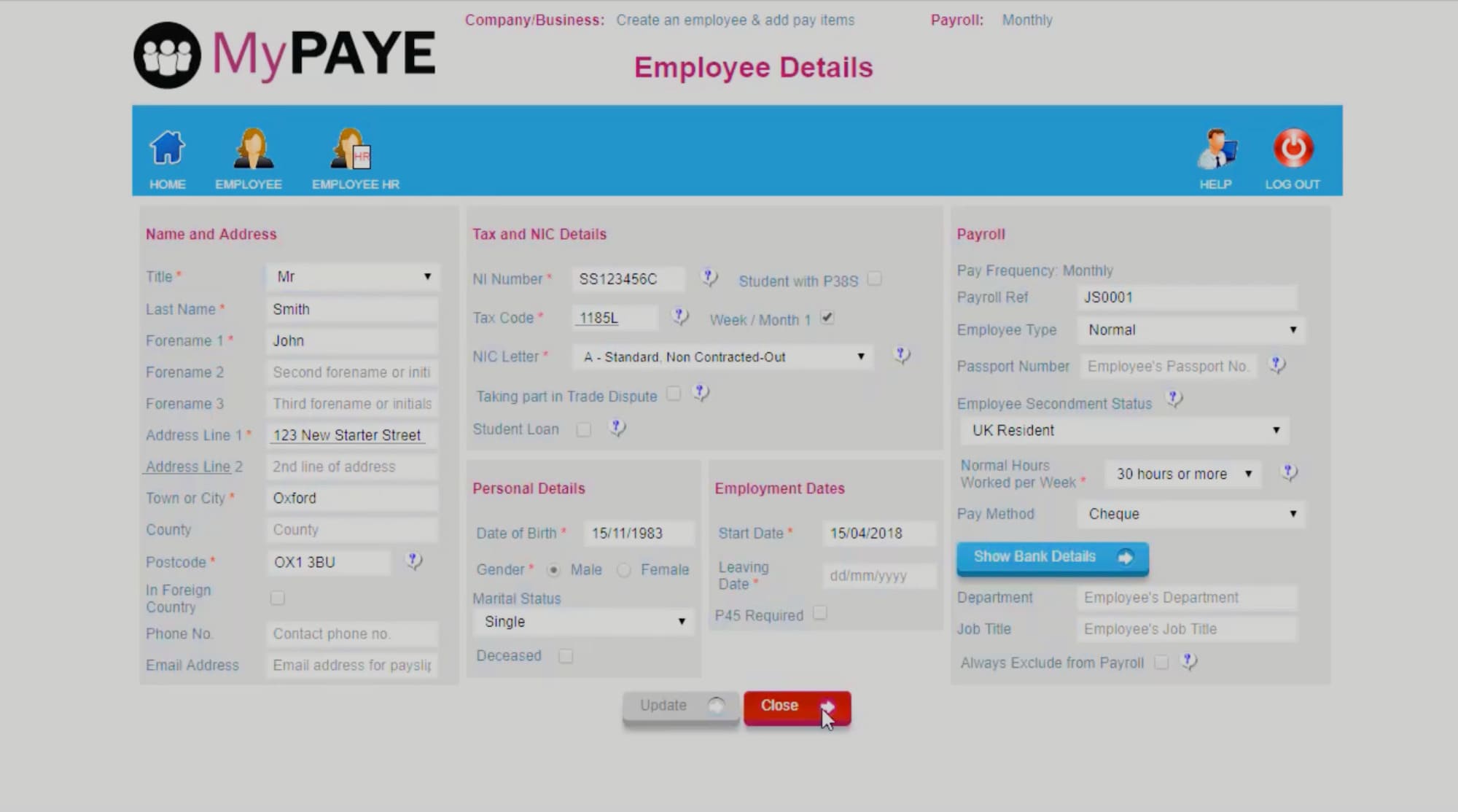

6. MyPAYE

MyPAYE is designed to make payroll simple and efficient for small businesses. It provides direct integration with HMRC, ensuring compliance with UK payroll regulations. Features include automated tax calculations, electronic payslip generation, and a comprehensive set of reporting tools. MyPAYE also offers a unique pricing model that scales with the number of employees, making it an economical choice for businesses looking to manage costs while maintaining a reliable payroll system.

Prices

MyPAYE pricing starts at around £1 per employee per month, with no setup fees, making it an economical choice for small businesses.

Best suited for?

MyPAYE is best suited for small businesses that want a straightforward and affordable payroll solution with direct HMRC integration. It’s ideal for those who prefer a pay-as-you-grow pricing model that scales with the number of employees.

Conclusion – Choosing small business payroll software

Choosing the right cloud-based payroll software is crucial for the smooth operation of your small business. Each of the six options listed above offers unique features and benefits, designed to accommodate the varying needs of small businesses across different industries. When selecting a payroll solution, it is important to consider factors such as ease of use, integration capabilities, compliance features, and cost. By opting for a cloud-based system, small businesses can ensure that their payroll operations are efficient, compliant, and well-managed, freeing up valuable time and resources to focus on core business activities.

As an alternative to buying payroll software, see our guide to payroll services outsourcing.

FAQ – Small business payroll software

Payroll software automates the process of paying salaried, hourly, and contingent employees. It typically includes features to manage deductions, benefits, tax withholdings, and employee data. It also ensures compliance with employment laws and tax regulations.

Cloud-based payroll software offers several advantages for small businesses, including accessibility from any location, real-time data updates, and reduced need for in-house IT infrastructure. Additionally, it ensures data is backed up and secure, and often comes with regular updates to comply with the latest tax laws.

Most payroll software automatically calculates taxes required for each pay period for every employee, accounting for federal, state, and local taxes. It often includes features to file and pay taxes directly through the software, ensuring compliance and reducing the risk of errors.

Yes, many payroll software solutions can integrate with other business systems such as human resources management systems (HRMS), accounting software, and time tracking applications. This integration helps streamline various business processes, reducing manual data entry and the potential for errors.

When choosing payroll software, consider factors such as ease of use, cost, scalability, customer support, and specific features like tax filing, payment methods, and compliance management. Also, look for reviews and testimonials to gauge the software’s reliability and customer satisfaction.

Many payroll software providers offer scalable solutions that are suitable for very small businesses or startups. Some offer basic packages or free tiers that are cost-effective for smaller teams, making them ideal for businesses just starting out.

Cloud-based payroll software generally offers high levels of security, including data encryption, secure data centers, and regular security audits. It’s important to select a provider that follows best practices in security to protect sensitive payroll and employee data.

The cost can vary widely based on the number of employees, the complexity of the payroll needs, and the features required. Basic plans can start from as little as £1 per employee per month and can go up significantly with more advanced features and higher employee counts.

Implementation time can vary based on the complexity of the business’s payroll needs and the software itself. Simpler systems can be set up in a few hours, while more integrated solutions might take several weeks to fully configure and deploy.

Most reputable payroll software providers offer robust customer support, including online resources, live chat, phone support, and email help. Some may offer dedicated account managers for more personalised assistance.