Xero, a popular accounting software provider, offers a payroll solution designed to simplify compliance and payroll management. This article provides a comprehensive review of Xero Payroll pricing structure, examining its various versions and tiers to help UK businesses make an informed decision.

Overview of Xero Payroll

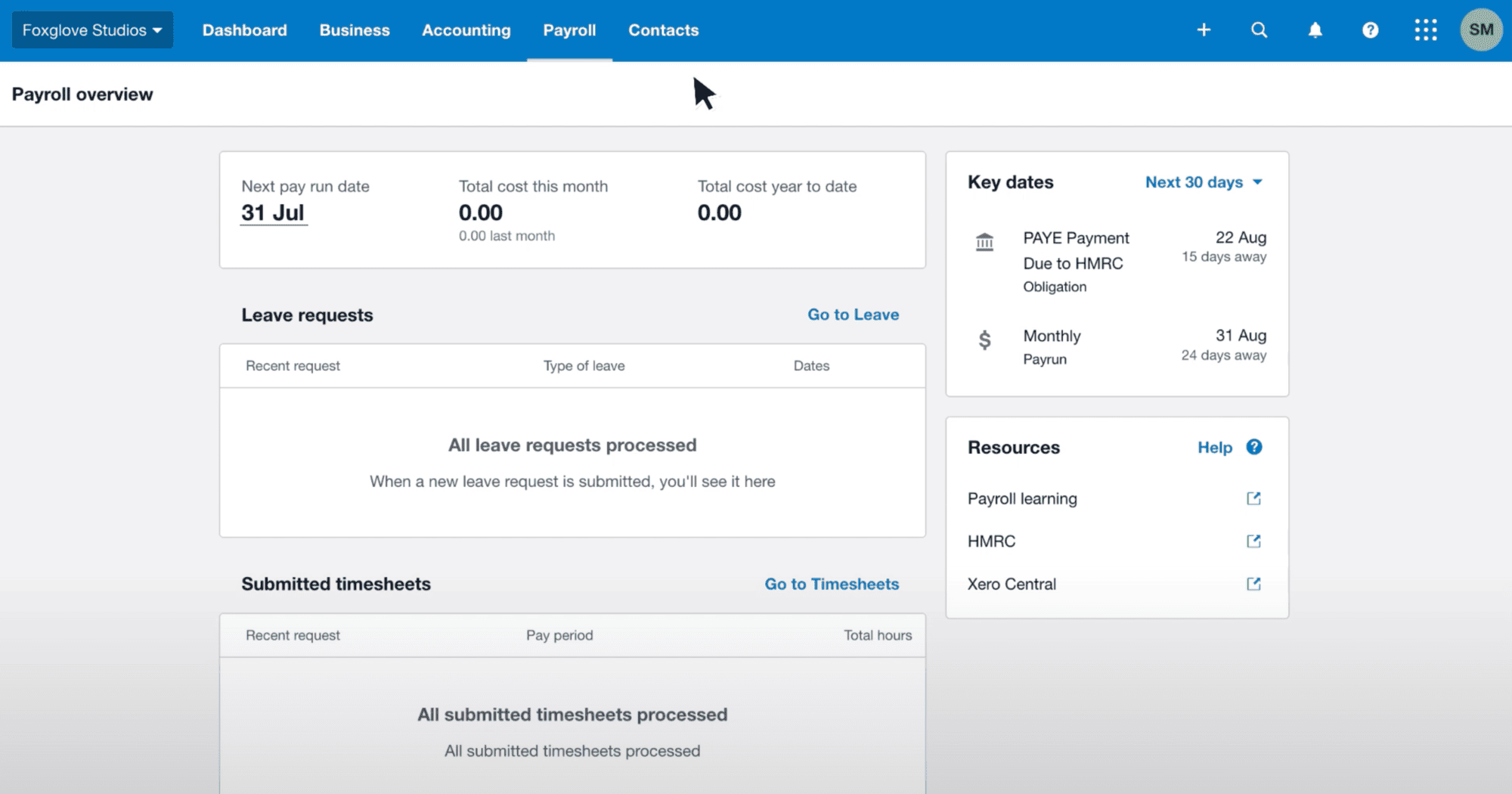

Xero Payroll is part of the broader Xero suite, known for its user-friendly interface and seamless integration with other business functions such as accounting, invoicing, and inventory management.

The payroll feature is designed to automate the complex processes involved in managing employee payments, tax calculations, pension contributions, and reporting.

Xero Payroll pricing list

| Plan | Price | Employees Included | Cost per Additional Employee | Key Features |

|---|---|---|---|---|

| Starter Plan | £12 per month | Up to 1 | N/A | – Automated payroll calculations – HMRC compliance (RTI submissions) – Pensions auto-enrolment – Employee portal for payslips and leave requests – Integration with Xero accounting |

| Standard Plan | £26 per month | Up to 5 | £5 per month per additional employee | – All Starter Plan features – Multiple pay schedules – PAYE and National Insurance calculations – Detailed payroll reports – Employee self-service portal – Integration with timesheets and pension providers |

Xero Payroll pricing tiers

Xero Payroll offers a straightforward pricing model, making it accessible to businesses of various sizes. As of the latest update, Xero Payroll is available in two main pricing tiers: the Starter plan and the Standard plan. Each tier offers different features tailored to specific business needs.

1. Starter plan

Price: £12 per month

Employees: Up to 1 employee

Features:

- Automated payroll calculations

- HMRC (Her Majesty’s Revenue and Customs) compliance, including real-time information (RTI) submissions

- Pensions auto-enrolment

- Employee portal for payslips and leave requests

- Integration with Xero’s accounting software

Ideal for: Sole traders or very small businesses with only one employee. The Starter plan provides essential payroll functionalities at an affordable price, making it an attractive option for new or small-scale businesses.

2. Standard plan

Price: £26 per month + £5 per month per additional employee after the first 5 employees

Employees: Up to 5 employees included in the base price

Features:

- All features included in the Starter plan

- Management of multiple pay schedules

- Automatic calculation and filing of PAYE (Pay As You Earn) and National Insurance contributions

- Detailed payroll reports

- Employee self-service portal for leave management and payslip access

- Integration with timesheets for tracking hours worked

- Integration with pension providers for auto-enrolment

Ideal for: Small to medium-sized businesses with more than one employee. The Standard plan offers a comprehensive set of features to handle more complex payroll requirements, making it suitable for growing businesses.

Key considerations when choosing a Xero Payroll plan

- Number of employees: The Starter plan is limited to a single employee, making it suitable for sole traders or micro-businesses. For businesses with more than one employee, the Standard plan offers the flexibility to manage up to 5 employees in the base price, with the option to add more at an additional cost.

- Payroll complexity: Businesses with multiple employees or more complex payroll needs, such as different pay schedules, will benefit from the additional features offered in the Standard plan. This plan’s ability to handle automatic tax and National Insurance calculations and filings is crucial for ensuring compliance.

- Integration needs: Xero Payroll integrates seamlessly with Xero’s accounting software, providing a unified solution for managing finances. Businesses already using Xero for accounting will find this integration beneficial, as it allows for easy tracking of payroll expenses and reduces the risk of errors.

- Employee access: Both plans offer employee self-service portals, which can save time and reduce administrative workload by allowing employees to view payslips and manage leave requests online.

Additional benefits of Xero Payroll

- Ease of use: Xero is known for its intuitive interface, and its payroll function is no exception. Users can easily navigate the system, set up payroll, and process payments with minimal training.

- Scalability: As businesses grow, Xero Payroll can scale to accommodate more employees, ensuring that the software remains useful as needs evolve.

- Compliance: Xero Payroll is designed to stay updated with the latest HMRC regulations, reducing the risk of non-compliance and potential fines.

Conclusion – Xero Payroll pricing review

Choosing the right payroll software is a critical decision for any business. Xero Payroll offers a reliable and scalable solution that caters to the needs of small to medium-sized businesses.

By understanding the different pricing tiers and assessing their specific needs, UK businesses can select the most appropriate plan, ensuring efficient and compliant payroll management.

Whether you are a sole trader looking for a simple solution or a growing business needing more robust features, Xero Payroll provides a range of options to meet your needs.

Its integration with Xero’s accounting software and commitment to compliance make it a valuable tool for businesses seeking to streamline their payroll processes.

For more, see our guide to payroll services costs. Or if you’d rather manage your own payroll, check our reviews of the best small business payroll software. Finally, for those on a tighter budget, see free payroll software.

Xero Payroll pricing FAQ

The starting price of Xero Payroll is £12 per month. This price applies to the Starter plan, which includes payroll management for up to 1 employee.

For 5 employees, Xero Payroll costs £26 per month under the Standard plan. This includes the base price for up to 5 employees.

Yes, Xero Payroll offers a plan for more than 5 employees. Under the Standard plan, it costs £26 per month for the first 5 employees, plus an additional £5 per month for each employee beyond the initial 5.

Yes, you can use Xero Payroll for just one employee. The price for this is £12 per month under the Starter plan, which is designed for businesses with a single employee.

Adding an additional employee to Xero Payroll’s Standard plan costs £5 per month for each additional employee beyond the first 5 included in the base price.

No, Xero Payroll does not have a fixed price for all businesses. The Starter plan is priced at £12 per month for 1 employee, while the Standard plan is priced at £26 per month for up to 5 employees, with a £5 per month charge for each additional employee.

No, there is no setup fee for Xero Payroll. Businesses can start using the service with the monthly pricing of either £12 for the Starter plan or £26 for the Standard plan, depending on their employee count.

Xero Payroll pricing of £12 per month for the Starter plan and £26 per month for the Standard plan (plus £5 per additional employee) is competitive, especially considering the integration with Xero’s broader accounting software and the comprehensive features offered.

As of now, Xero Payroll does not advertise specific discounts on their monthly pricing. The costs are straightforward: £12 per month for the Starter plan and £26 per month for the Standard plan, plus £5 for each additional employee beyond the first 5.

If your employee count changes, your Xero Payroll costs will adjust accordingly. Under the Standard plan, you will pay £26 per month for up to 5 employees, and £5 per month for each additional employee. If the number of employees decreases, the cost will reflect the lower employee count.