In today’s economic landscape, UK businesses, especially small to medium-sized enterprises (SMEs), are constantly seeking ways to enhance efficiency while managing costs effectively. Payroll processing is an essential yet complex aspect of business operations that requires precision and can be resource-intensive. Fortunately, the rise of free payroll software offers an attractive solution for businesses looking to streamline this function at minimal cost.

This article reviews six robust free payroll software options tailored for the UK market, detailing their features and potential benefits for your business.

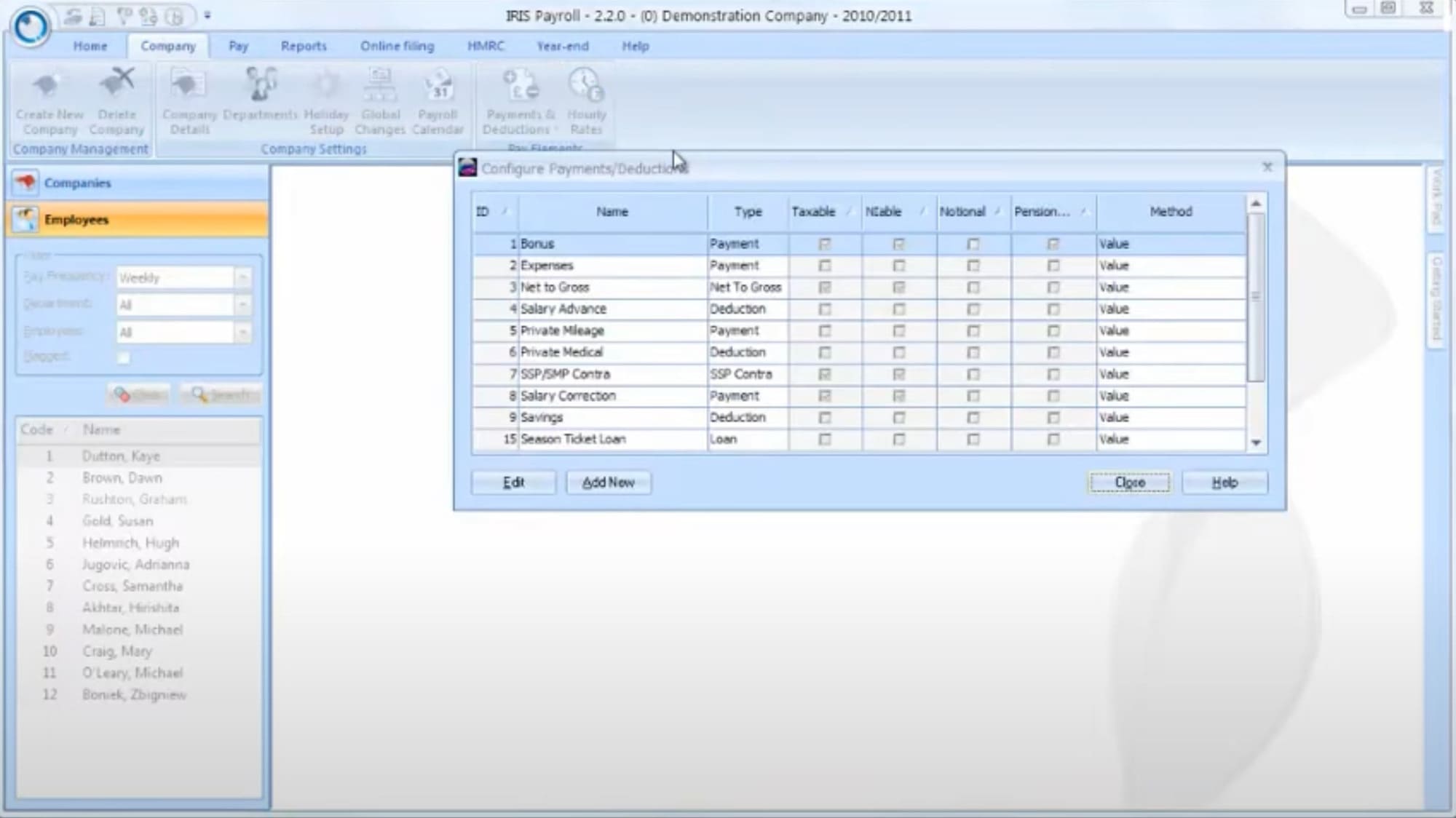

1. IRIS Payroll Basics

IRIS Payroll Basics caters specifically to small businesses with fewer than 10 employees, offering a no-cost solution that handles essential payroll tasks. This software automates PAYE and National Insurance calculations, and it supports multiple payroll frequencies. Users can generate electronic or printed payslips directly from the system, ensuring compliance with UK tax laws and simplifying end-of-year reporting.

What’s included for free?

IRIS Payroll Basics is completely free for businesses with fewer than 10 employees. It includes functionality for calculating PAYE, National Insurance, and generating electronic or printed payslips. Users can manage different payroll frequencies and handle year-end reporting, all within this free tier.

Pricing outside of free tier

IRIS Payroll Basics is designed specifically for small businesses and does not have additional paid tiers. For businesses that outgrow its capabilities, IRIS offers other software solutions with more advanced features, which do come at a cost.

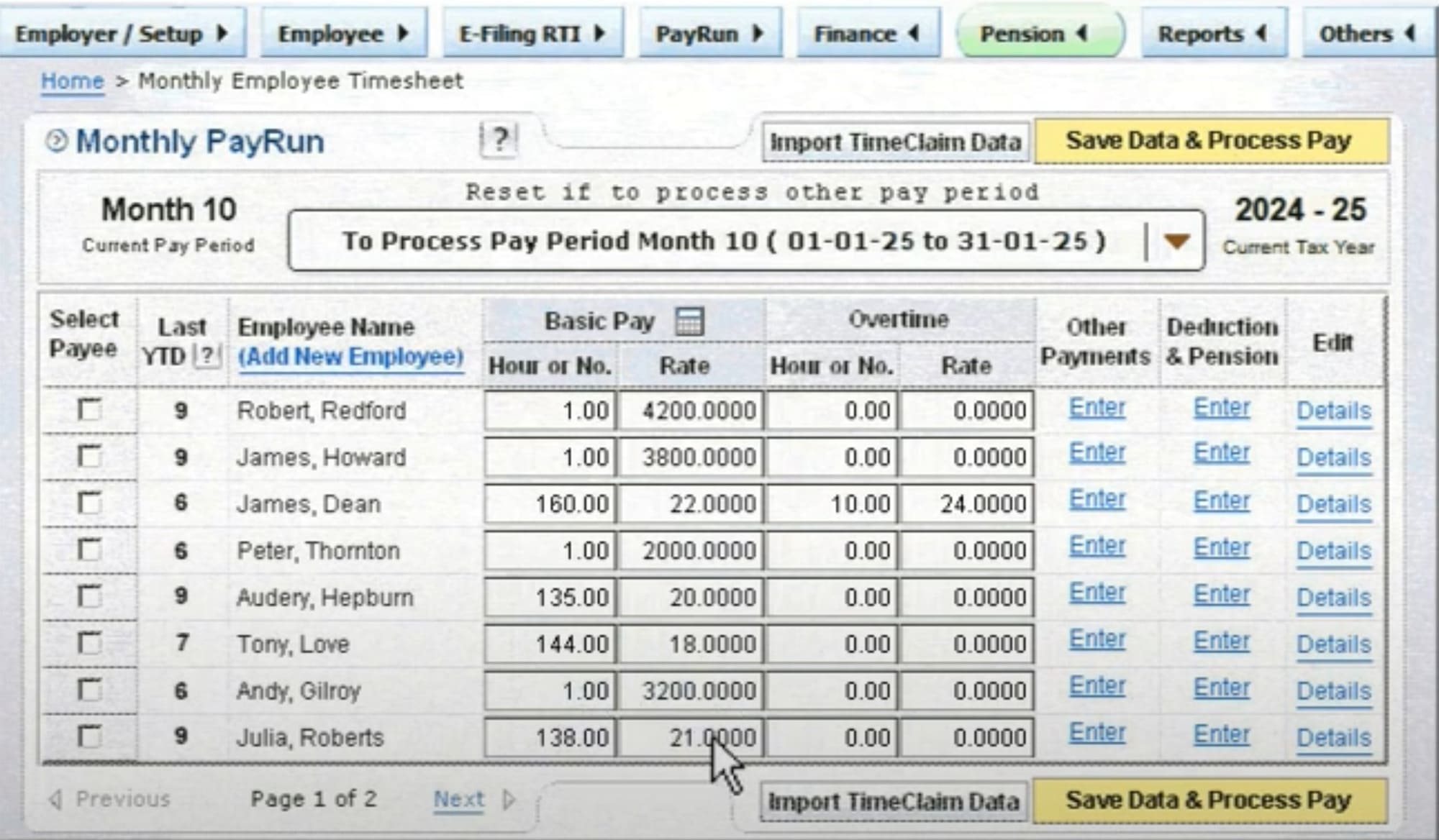

2. 1 2 Cloud Payroll

1 2 Cloud Payroll provides a cloud-based payroll solution that is free for small businesses. It features an intuitive interface that makes payroll processing straightforward, even for those with minimal experience. The platform includes automatic tax calculations, real-time HMRC submissions, and the ability to manage payslips and year-end reports. Its cloud nature ensures that it’s accessible from anywhere, providing flexibility for business owners on the move.

What’s included for free?

1 2 Cloud Payroll provides a free tier that offers comprehensive payroll processing capabilities, including automatic tax calculations, real-time HMRC submissions, and digital payslip management. The free version is generally adequate for small businesses looking for basic payroll processing.

Pricing outside of free tier

For businesses requiring more advanced features such as integrated HR systems or enhanced reporting tools, 1 2 Cloud Payroll may offer paid upgrades or additional services, though specifics are generally provided upon request.

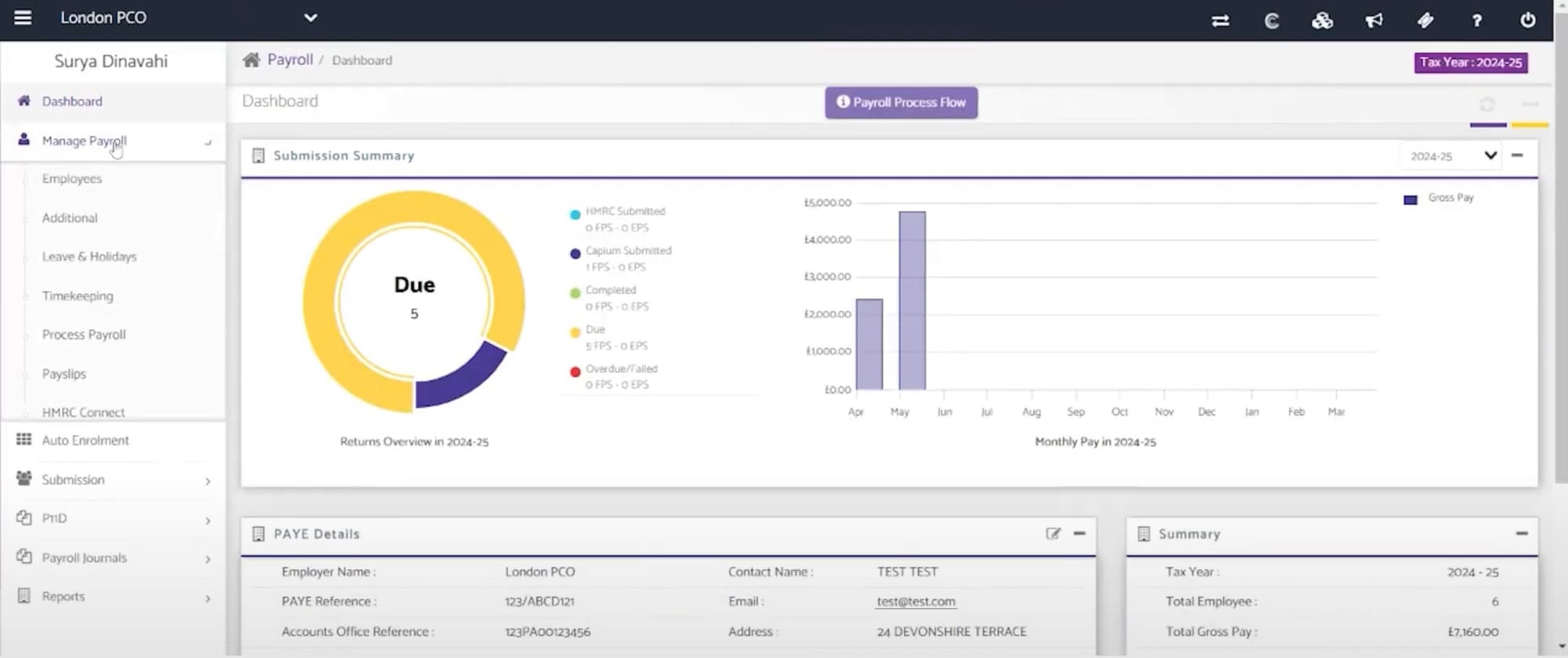

3. Capium Payroll

Capium Payroll is another excellent free option designed to simplify the payroll process for small businesses. It offers a comprehensive set of features including auto-enrolment for pensions, real-time information (RTI) submissions, and a direct link to HMRC. The software is particularly noted for its user-friendly dashboard and efficient customer support, making it a dependable choice for businesses that prioritise ease of use and reliability.

What’s included for free?

Capium Payroll’s free tier supports a limited number of employees and includes features like auto-enrolment for pensions, RTI submissions, and a direct link to HMRC. This plan is typically suited for small businesses that need straightforward payroll processing.

Pricing outside of free tier

Capium offers a range of paid services that provide expanded functionality, such as multi-user access, advanced financial reporting, and increased customer support options. Pricing for these services is tiered based on the number of employees and additional features required.

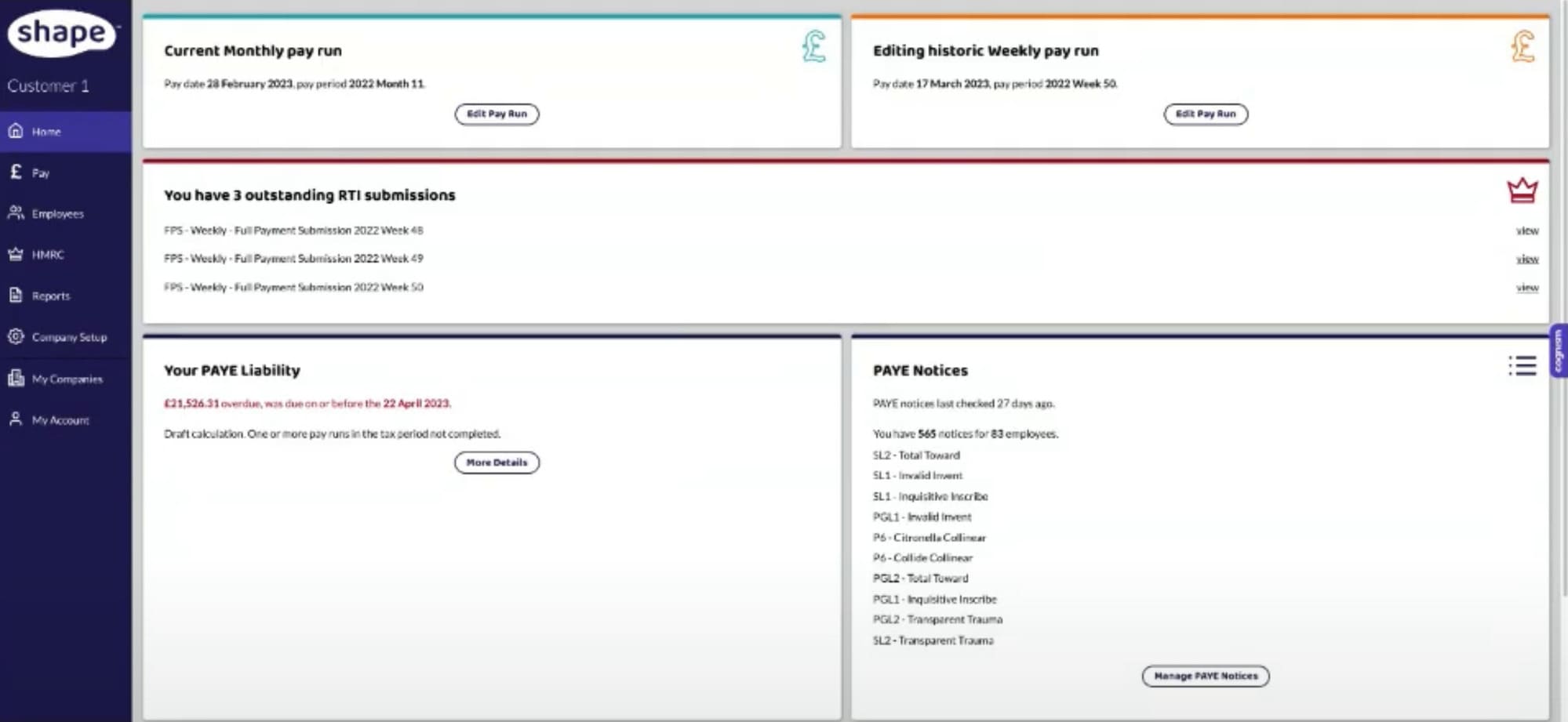

4. Shape Payroll Lite

Shape Payroll Lite stands out for its modern interface and robust functionality, which includes support for unlimited employees, making it scalable for businesses expecting to grow. It facilitates automated pension contributions, RTI submissions, and detailed payroll reporting. Shape Payroll is particularly appealing to tech-savvy business owners looking for a software that integrates seamlessly with other business systems.

What’s included for free?

Shape Payroll offers a robust “Lite” free tier that supports up to 3 employees, which is ideal for businesses just starting up. It includes automated pension contributions, RTI submissions, and extensive payroll reporting, making it a comprehensive option for startups and growing companies.

Pricing outside of free tier

For businesses seeking additional functionalities like API integrations, advanced security features, or personalised customer support, Shape Payroll may offer premium packages. The cost of these packages typically depends on the specific needs and size of the business.

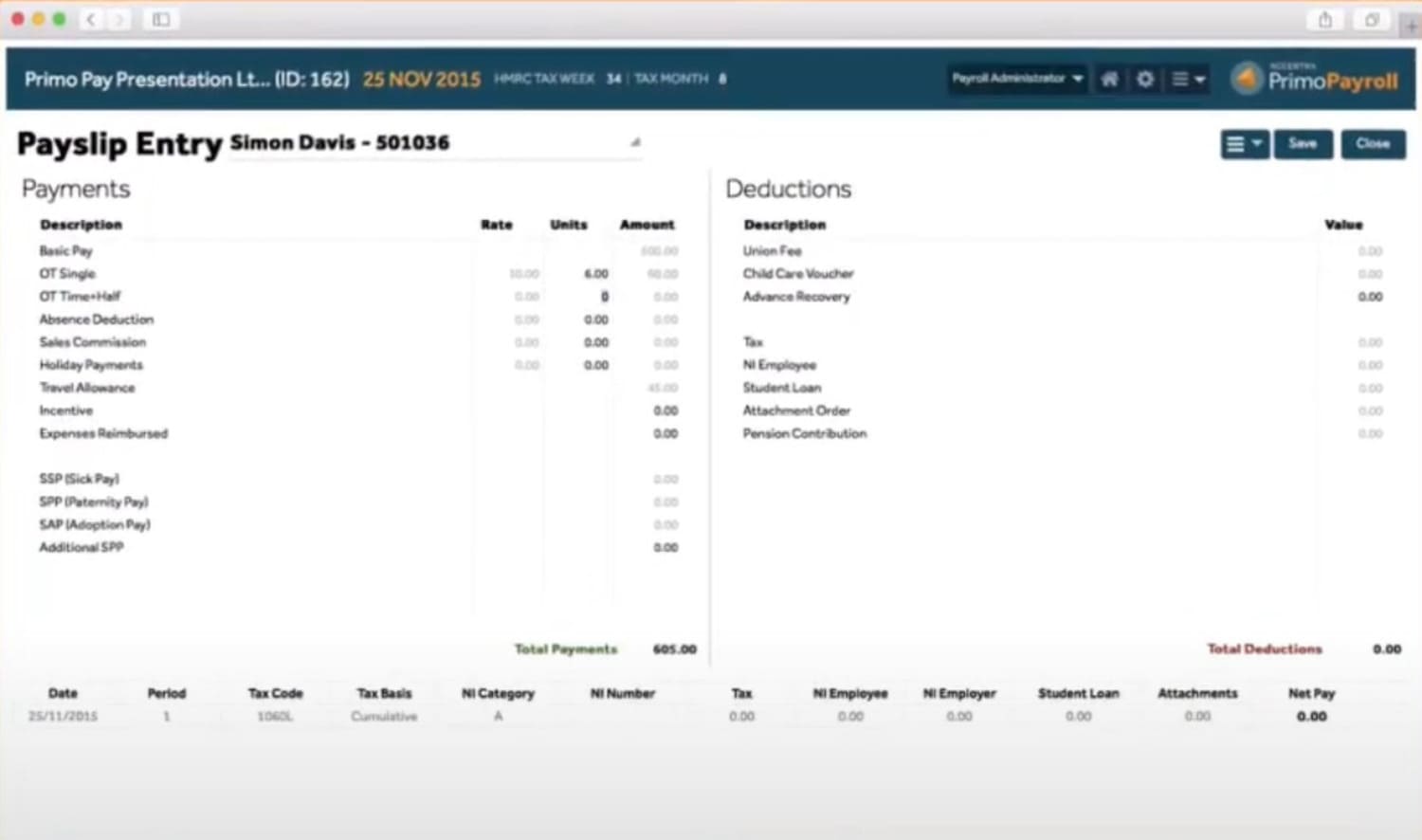

5. Primo Payroll Essentials Free Plus

Primo Payroll’s Essentials Free Plus offers a powerful payroll solution without a subscription fee for companies with up to 10 employees. This platform supports automated statutory calculations, customisable payslip designs, and comprehensive reporting tools. It also includes features like pension auto-enrolment and a self-service portal for employees, enhancing the overall payroll management experience.

What’s included for free?

Primo Payroll’s Essentials Free Plus is available for businesses with up to 10 employees and includes statutory calculations, customisable payslip designs, and detailed payroll reporting. The plan also features pension auto-enrolment and an employee self-service portal, which are typically paid features in other platforms.

Pricing outside of free tier

Primo Payroll offers more advanced features under its paid tiers, such as enhanced automation capabilities, integrated accounting, and more comprehensive HR tools. These additional services are priced based on the complexity and the number of employees.

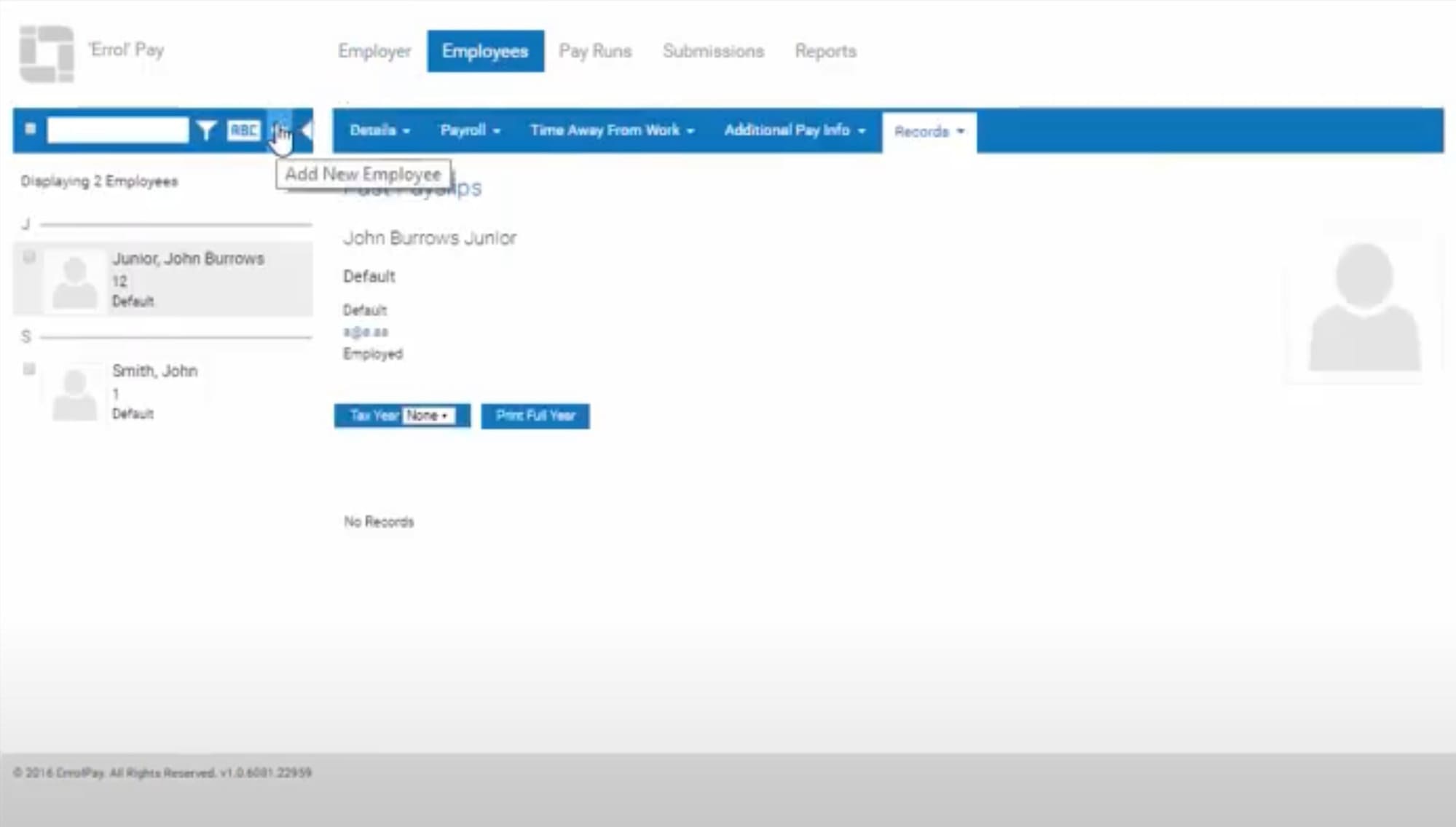

6. Enrolpay

Enrolpay is designed to cater to SMEs looking for a straightforward and effective payroll solution. It provides free access to essential features such as automatic calculations for taxes and deductions, payslip generation, and compliance with pension regulations. Enrolpay also boasts excellent customer support, which is crucial for businesses that might need assistance navigating the complexities of payroll processing.

What’s included for free?

Enrolpay’s free offering provides essential payroll functionalities like automatic tax and deduction calculations, payslip generation, and pension compliance. This makes it suitable for small businesses needing basic payroll services without additional complexity.

Pricing outside of free tier

For businesses that need more than just the basics, Enrolpay offers paid plans that include features like advanced reporting, multi-company management, and priority customer support. Pricing varies based on the number of employees and the level of functionality required.

Benefits of using free payroll software

Adopting free payroll software can provide several advantages for small and medium-sized businesses:

- Cost reduction: Significant savings on payroll administration costs.

- Regulatory compliance: Ensures adherence to current UK payroll legislation.

- Efficiency: Automates calculations and processes, saving time and reducing errors.

- Accessibility: Many options are cloud-based, providing access from any location.

- Scalability: Adaptable to both small operations and growing businesses.

Conclusion – Choosing free payroll software

For UK SMEs, choosing the right payroll software is crucial for maintaining operational efficiency and managing financial resources wisely.

The six free payroll software options discussed offer a range of features that cater to various business needs, from basic tax compliance to advanced functionalities like real-time data access and integrations with other systems.

By selecting an appropriate payroll software, UK businesses can achieve greater efficiency, ensure compliance, and focus more effectively on core business functions.

For more, see our guides to best small business payroll software and payroll services outsourcing.

FAQ about free payroll software

Free payroll software is a type of application that helps businesses manage their payroll processes without an initial cost. This typically includes calculating wages, withholding taxes, and generating payslips. Free software often offers essential features suitable for small businesses or startups.

While the core functions of free payroll software are available at no cost, there might be fees for additional features such as automated tax filing, advanced reporting tools, or support for more employees. Always check the details of what’s included in the free tier versus what requires a paid upgrade.

Most free payroll software will calculate taxes and may include the ability to file these taxes electronically, but the capabilities can vary. Some software may require manual submissions or upgrading to a paid service for automated filings. It’s important to verify that the software complies with current UK tax laws and HMRC requirements.

Reputable free payroll software providers implement robust security measures to protect sensitive data, such as employee personal information and financial details. Look for features like encryption, secure data storage, and compliance with data protection regulations.

Free payroll software providers typically use a freemium business model. The basic software is free to attract users, and the provider may offer paid upgrades for advanced features or additional capacity. Alternatively, some companies may offer free software as a way to introduce you to their brand, hoping you’ll purchase other services.

Free payroll software is generally designed for small businesses and startups with a limited number of employees. As businesses grow and their payroll needs become more complex, they might need to switch to more robust paid software that can handle additional requirements like larger workforce management, detailed customisation, and comprehensive analytics.

When choosing free payroll software, consider factors like the number of employees you have, your specific payroll needs, the ease of use of the software, and the level of customer support provided. It’s also crucial to review any limitations of the free version and how much it would cost to upgrade if needed.

If your business outgrows the free software, you can either upgrade to a paid plan with your current provider or switch to another software that can better accommodate your growing needs. When considering a switch, evaluate how easy it is to transfer your payroll data and the costs involved.

Switching payroll software can be straightforward, but it depends on the compatibility of the systems involved. Most providers offer support during the migration process, and some software can directly import data from other systems. However, it’s wise to plan the transition carefully to avoid errors.

Support offerings vary by provider. Some free payroll software includes access to basic support services, such as online help articles and user forums. More extensive support, like telephone or live chat assistance, might only be available through a paid plan.