For many small to medium-sized businesses in the UK, IRIS Payroll Basics is a popular payroll software choice due to its user-friendly interface and cost-effective pricing. This article provides an in-depth review of IRIS Payroll Basics pricing, key features, and considerations for businesses looking to invest in payroll software.

Understanding the importance of payroll software

Payroll software automates the process of paying employees, calculating taxes, and handling deductions. It helps businesses reduce the risk of errors, save time, and ensure compliance with HMRC regulations. Choosing the right payroll software is crucial for any business, as it can directly impact employee satisfaction and the company’s overall financial management.

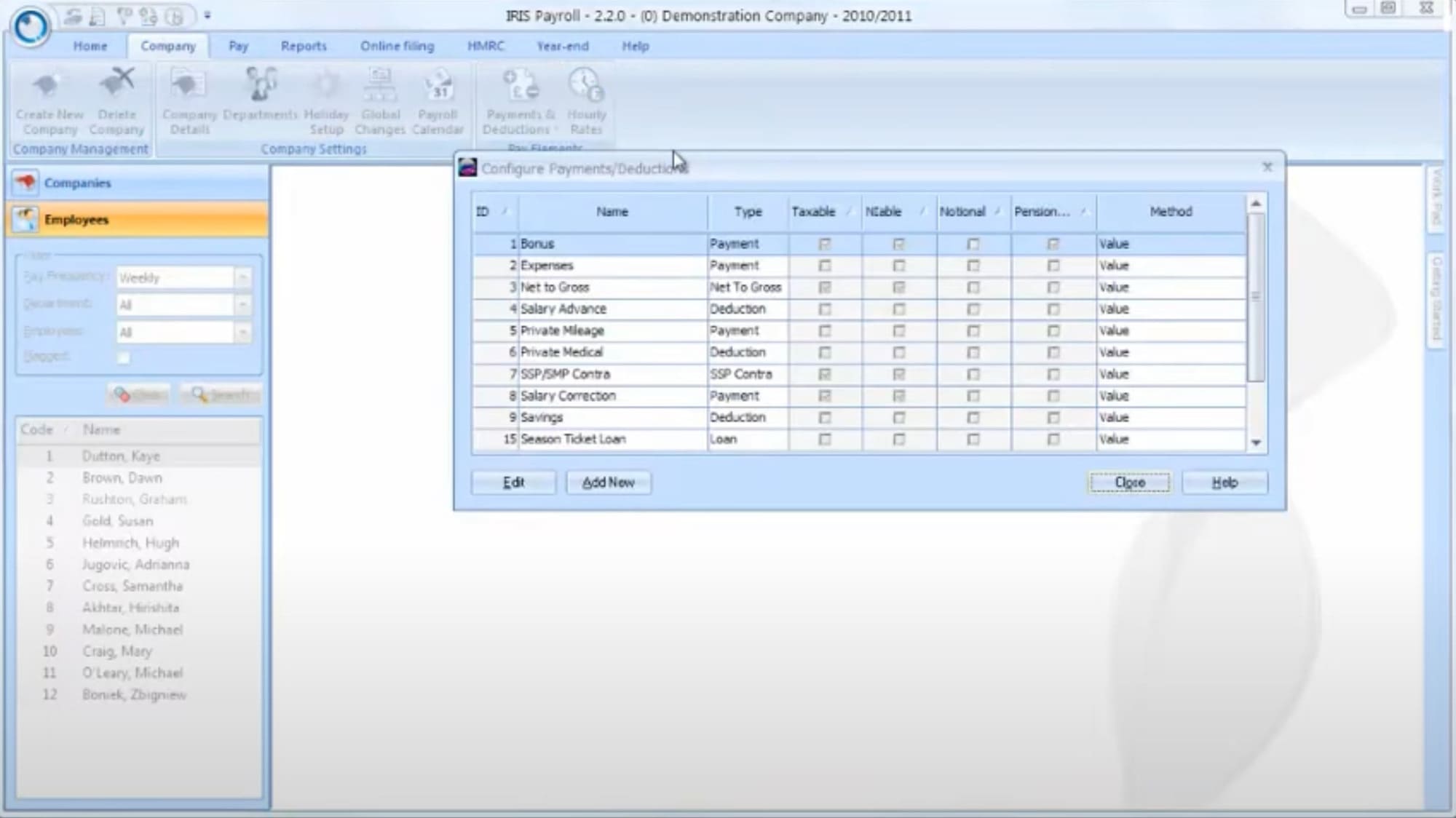

Overview of IRIS Payroll Basics

IRIS Payroll Basics is a software solution designed for small businesses that require a straightforward and efficient payroll system. It is particularly suitable for companies with a limited number of employees, providing a cost-effective solution without compromising on essential features. The software is recognised for its ease of use, making it an excellent choice for businesses that may not have dedicated payroll staff.

Key features of IRIS Payroll Basics

Before diving into the pricing, it is important to understand what IRIS Payroll Basics offers. Some of the key features include:

- Automatic calculations: The software automates the calculation of wages, deductions, and tax, ensuring accuracy and saving time.

- HMRC compliance: IRIS Payroll Basics is fully compliant with HMRC requirements, making it easier for businesses to stay up-to-date with tax regulations and reporting.

- Payslip generation: It allows businesses to generate and distribute electronic payslips to employees, which can be customised to include all relevant information.

- Real-Time Information (RTI) submissions: The software facilitates RTI submissions to HMRC, ensuring that businesses meet their legal obligations.

- Employee management: Basic employee management features allow businesses to maintain employee records, including personal details, tax codes, and payment information.

IRIS Payroll Basics pricing list

| Item | Description | Cost (Excluding VAT) |

|---|---|---|

| Annual Licence Fee | Covers all basic payroll features for up to 10 employees | £70 |

| Additional Employee Costs | For businesses with more than 10 employees | Varies (contact IRIS for specific pricing) |

| Support and Updates | Included in the annual licence fee | Included |

| HMRC Compliance Features | Real-Time Information (RTI) submissions, tax calculations, etc. | Included |

| Payslip Generation | Customisable electronic payslips | Included |

| Additional Support Options | More comprehensive support packages | Available at extra cost |

Pricing structure of IRIS Payroll Basics

One of the most appealing aspects of IRIS Payroll Basics for small businesses is its transparent and affordable pricing model. The software offers a straightforward, no-nonsense pricing structure that is easy to understand.

- Annual licence fee: IRIS Payroll Basics is available on an annual subscription basis. As of the latest pricing update, the annual licence fee is approximately £70 (plus VAT). This fee covers all the basic features needed for payroll management for up to 10 employees.

- Additional employee costs: For businesses that have more than 10 employees, there may be an additional cost. However, IRIS Payroll Basics is designed to cater primarily to smaller businesses, and those with a larger workforce might consider other products in the IRIS portfolio.

- Support and updates: The annual licence fee includes access to software updates and basic support. This ensures that the software remains compliant with any changes in HMRC regulations and that users can access assistance if needed.

Benefits of IRIS Payroll Basics

For small businesses, IRIS Payroll Basics offers several advantages:

- Cost-effective: With a low annual fee, it provides a budget-friendly solution for small businesses.

- Ease of use: The software is designed to be intuitive, making it accessible even to those without extensive payroll experience.

- Compliance: Ensures that businesses are compliant with HMRC regulations, reducing the risk of penalties and errors.

- Time-saving: Automating payroll processes frees up time for business owners to focus on other critical areas of their operations.

Considerations when choosing payroll software

While IRIS Payroll Basics is an excellent choice for many small businesses, there are some factors to consider when choosing payroll software:

- Business size: Evaluate the number of employees your business has. If your workforce is expected to grow significantly, consider whether the software can scale with your needs.

- Feature requirements: Assess whether the features offered by IRIS Payroll Basics meet all your payroll needs. If you require more advanced features, you may need to explore other options.

- Integration: Consider whether the software can integrate with other systems you use, such as accounting software or HR management tools.

- Support needs: While IRIS Payroll Basics includes basic support, evaluate whether you might need more comprehensive support options, especially if you lack in-house expertise.

Conclusion – IRIS Payroll Basics pricing review

Choosing the right payroll software is a critical decision for any business. IRIS Payroll Basics offers a cost-effective, user-friendly solution that meets the needs of many small businesses.

With its straightforward pricing and essential features, it provides a reliable option for businesses looking to streamline their payroll processes while ensuring compliance with HMRC regulations.

By carefully evaluating your business’s needs and considering the factors outlined in this guide, you can make an informed decision and select the payroll software that best supports your company’s growth and success.

For more, see our guide to payroll services costs. Or if you’d rather manage your own payroll, check our reviews of the best small business payroll software. Finally, for those on a tighter budget, see free payroll software.

IRIS Payroll Basics pricing FAQ

The annual cost of IRIS Payroll Basics is £70 (excluding VAT). This fee covers the basic features and is applicable for managing payroll for up to 10 employees.

IRIS Payroll Basics is primarily designed for businesses with up to 10 employees. If your business has more than 10 employees, additional costs may apply. The specific pricing for more than 10 employees varies, and it is recommended to contact IRIS directly for a tailored quote.

Yes, the annual fee of £70 for IRIS Payroll Basics includes access to basic support and software updates. This ensures that the software remains compliant with any changes in HMRC regulations and that users can get help when needed.

No, IRIS Payroll Basics is known for its transparent pricing. The annual fee of £70 covers all the basic features needed for payroll management for up to 10 employees. However, if additional employees are added or more comprehensive support is required, there may be extra costs.

IRIS Payroll Basics accepts various payment methods for the annual fee of £70. Businesses can typically pay via credit card, debit card, or direct bank transfer. For more details on payment methods, it’s best to contact IRIS directly.

IRIS Payroll Basics may offer refunds under specific circumstances. Refund policies can vary, so it is recommended to review the terms and conditions provided by IRIS. Generally, refunds might be available if the cancellation occurs within a specific timeframe after purchase.

IRIS Payroll Basics occasionally offers a free trial period for businesses to evaluate the software before committing to the annual fee of £70. To find out if a free trial is currently available, check the IRIS website or contact their sales team.

The IRIS Payroll Basics subscription is renewed annually. The annual fee of £70 is due each year to continue using the software, access updates, and receive support.

IRIS Payroll Basics typically charges an annual fee of £70, and discounts for multi-year subscriptions may be available. Businesses interested in such discounts should contact IRIS directly to inquire about current offers or bulk pricing options.

While IRIS Payroll Basics covers the essential features needed for small businesses, additional features or more advanced versions of IRIS software may be available at extra cost. The pricing for these additional features varies, so it’s advisable to contact IRIS for specific details and quotes based on your business needs.