Sage Business Cloud Payroll is a popular choice among small to medium-sized enterprises (SMEs) due to its comprehensive features and scalable pricing. This article provides a detailed review of Sage Business Cloud Payroll pricing and features across its various versions and tiers, helping you decide which option best suits your business needs.

Why choose Sage Business Cloud Payroll?

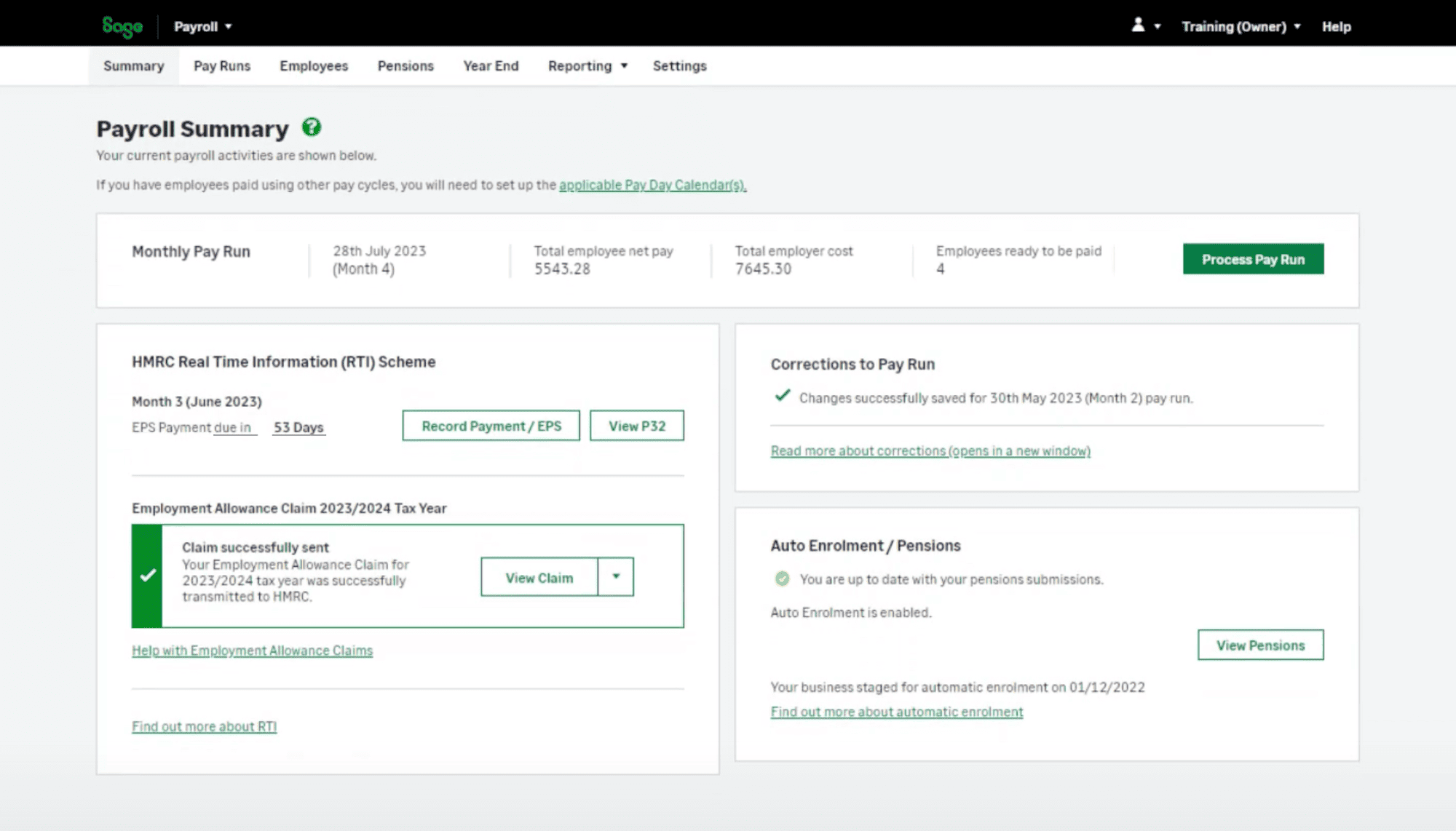

Sage Business Cloud Payroll is designed to help businesses manage their payroll processes efficiently.

It offers a range of features that cater to different business sizes, including automatic calculations, compliance with HMRC regulations, and easy integration with accounting software.

The platform’s scalability makes it an ideal choice for growing businesses, as it allows you to upgrade as your payroll needs expand.

Sage Business Cloud Payroll pricing list

| Pricing Tier | Monthly Price (excl. VAT) | Employee Limit | Key Features |

|---|---|---|---|

| Payroll 5 | £7 | Up to 5 | Automated payroll calculations, HMRC submissions, payslip generation, holiday and absence management, online support |

| Payroll 10 | £12 | Up to 10 | All features of Payroll 5, plus capacity for more employees |

| Payroll 15 | £17 | Up to 15 | All features of Payroll 10, with additional capacity |

| Payroll 25 | £27 | Up to 25 | Comprehensive payroll management for larger businesses |

Overview of pricing tiers

Sage Business Cloud Payroll offers a variety of pricing tiers, each designed to cater to businesses with different payroll needs. The tiers are based on the number of employees your business has, providing flexibility and scalability as your business grows. Each tier includes essential payroll features, ensuring compliance with HMRC regulations and automating the payroll process.

Payroll 5: £7 per month + VAT

- Designed for: Micro-businesses with up to 5 employees

- Key features: Automated payroll calculations, HMRC submissions, payslip generation, holiday and absence management, online support

This entry-level tier is perfect for small start-ups or micro-businesses needing an affordable, straightforward payroll solution.

Payroll 10: £12 per month + VAT

- Designed for: Small businesses with up to 10 employees

- Key features: All features of Payroll 5, with increased capacity to handle more employees

Payroll 10 is ideal for small businesses experiencing growth, offering a cost-effective way to manage payroll without scaling up too quickly.

Payroll 15: £17 per month + VAT

- Designed for: Businesses with up to 15 employees

- Key features: Includes all features from the lower tiers, suitable for managing a slightly larger workforce

As businesses grow, Payroll 15 provides additional capacity and support, making it a good fit for businesses on the brink of becoming medium-sized enterprises.

Payroll 25: £27 per month + VAT

- Designed for: Medium-sized businesses with up to 25 employees

- Key features: Comprehensive payroll management capabilities, supporting more substantial workforce requirements

For businesses that are more established and have a larger number of employees, Payroll 25 offers the scalability needed to handle complex payroll tasks while maintaining compliance and efficiency.

Additional features and considerations

Each tier of Sage Business Cloud Payroll provides a robust set of features suitable for businesses at different stages of growth. No matter which tier you choose, you will benefit from automated calculations, compliance support, and ease of use. Sage also offers add-ons and integrations, such as:

- Integration with Sage Accounting: Simplifies financial management by linking payroll with accounting functions.

- Auto-enrolment: Supports compliance with UK workplace pension regulations.

- Reporting and analytics: Provides insights into payroll costs and employee data to aid decision-making.

By selecting the appropriate tier, you can ensure that Sage Business Cloud Payroll meets your business’s current needs while remaining flexible enough to grow alongside your business.

Is Sage Business Cloud Payroll the right choice for your business?

Sage Business Cloud Payroll offers a range of pricing tiers designed to accommodate the needs of businesses of various sizes. Its flexible pricing structure and comprehensive features make it a compelling choice for SMEs looking to streamline their payroll processes. Whether you’re a small start-up with just a few employees or a growing business with a more substantial workforce, Sage Business Cloud Payroll has a tier that can meet your needs.

When selecting payroll software, consider the size of your business, the number of employees, and your specific payroll requirements. Sage Business Cloud Payroll’s scalability, ease of use, and compliance with HMRC regulations make it a reliable option for UK businesses looking to manage payroll efficiently.

By carefully assessing your needs and understanding the features and pricing of each tier, you can make an informed decision that will benefit your business and support its growth.

For more, see our guide to payroll services costs. Or if you’d rather manage your own payroll, check our reviews of the best small business payroll software. Finally, for those on a tighter budget, see free payroll software.

FAQ – Sage Business Cloud Payroll pricing

Yes, Sage Business Cloud Payroll offers a 30-day free trial for new users to explore its features.

Yes, you can upgrade or downgrade your Sage Business Cloud Payroll tier at any time based on your business needs.

No, there are no setup fees for Sage Business Cloud Payroll; you only pay the monthly subscription fee.

Currently, Sage Business Cloud Payroll does not offer discounts for annual payments, and pricing is on a monthly basis.

Sage Business Cloud Payroll accepts payment by credit or debit card for its monthly subscription fees.

No, online support is included in all Sage Business Cloud Payroll tiers at no additional cost.

Yes, all software updates and new features are included in your Sage Business Cloud Payroll subscription.

Yes, Sage Business Cloud Payroll can seamlessly integrate with other Sage products like Sage Accounting.

Sage offers online resources and guides, but one-on-one training may be available at an additional cost.

No, Sage Business Cloud Payroll operates on a monthly subscription model with no long-term contracts, allowing flexibility to cancel at any time.