Running a business in the UK has never been more complex. From rising energy bills to regional wage disparities, understanding the true cost of doing business is critical for small and medium-sized enterprises (SMEs) trying to stay competitive.

To provide clarity, we’ve compiled the UK Business Affordability Index 2025, analysing and ranking the 30 largest UK towns and cities by the average cost of key business essentials. Our goal: to reveal where it’s most and least affordable to run a business in today’s economic climate.

Methodology – What’s included?

We analysed six core cost categories for each location:

- Local salaries – average cost to employ workers in the area

- Office rent – average cost per square metre per year for commercial space

- Business energy – combined electricity and gas estimates for small businesses

- Insurance premiums – average cost of essential public liability and business cover

- Broadband – standard business broadband costs per year

- Business rates – average local commercial rates for small premises

Each city was assigned a standardised cost score, using z-scores to normalise the data. A lower score indicates better affordability. We then ranked all 30 cities from most to least affordable.

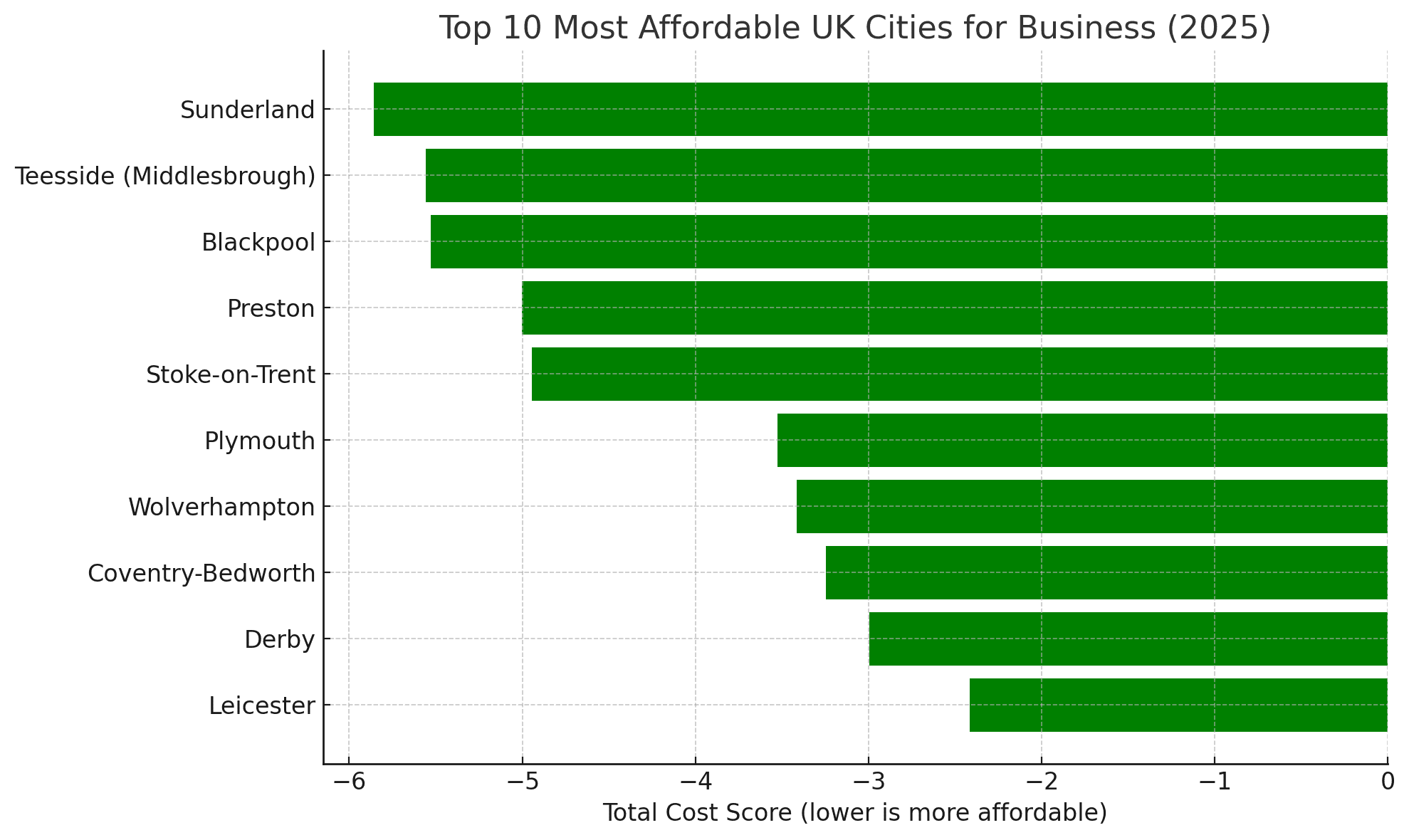

Most affordable UK cities for businesses in 2025

These cities offer the lowest combined operational costs, making them attractive hubs for SMEs and start-ups:

| Rank | City |

|---|---|

| 1 | Sunderland |

| 2 | Teesside (Middlesbrough) |

| 3 | Blackpool |

| 4 | Preston |

| 5 | Stoke-on-Trent |

| 6 | Plymouth |

| 7 | Wolverhampton |

| 8 | Coventry-Bedworth |

| 9 | Derby |

| 10 | Leicester |

These locations stand out for their competitive energy bills, low insurance premiums, and relatively affordable office rents. They represent strong value for retail, logistics, professional services, and start-up firms seeking regional growth opportunities.

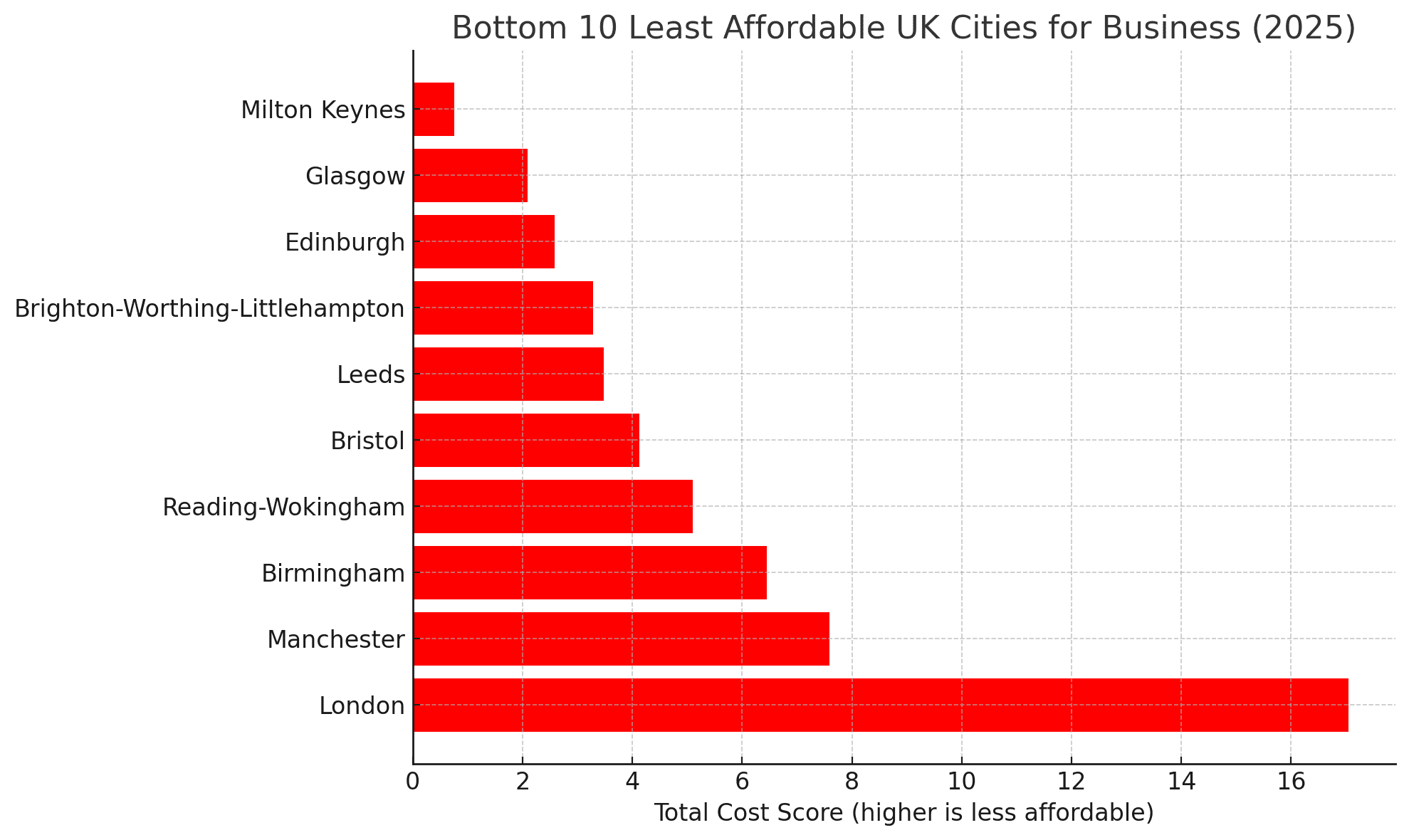

Least affordable UK cities for businesses in 2025

At the other end of the scale, these cities are the costliest to operate in, driven largely by high office space costs, rates, and broadband fees:

| Rank | City |

|---|---|

| 30 | London |

| 29 | Manchester |

| 28 | Birmingham |

| 27 | Reading-Wokingham |

| 26 | Bristol |

| 25 | Leeds |

| 24 | Brighton-Worthing-Littlehampton |

| 23 | Edinburgh |

| 22 | Glasgow |

| 21 | Milton Keynes |

While these areas benefit from strong infrastructure, talent pools, and market access, the operational costs may require additional planning and budget allowances, particularly for SMEs with fixed premises.

Why this matters

For small businesses and entrepreneurs, understanding geographic cost variation is more important than ever. Whether you’re planning to open a new office, relocate, or scale, knowing where you’ll get the most value for money can significantly impact long-term success.

Moreover, local councils, business parks, and investors can use this data to better support regional development by identifying pain points or promotional opportunities in their areas.

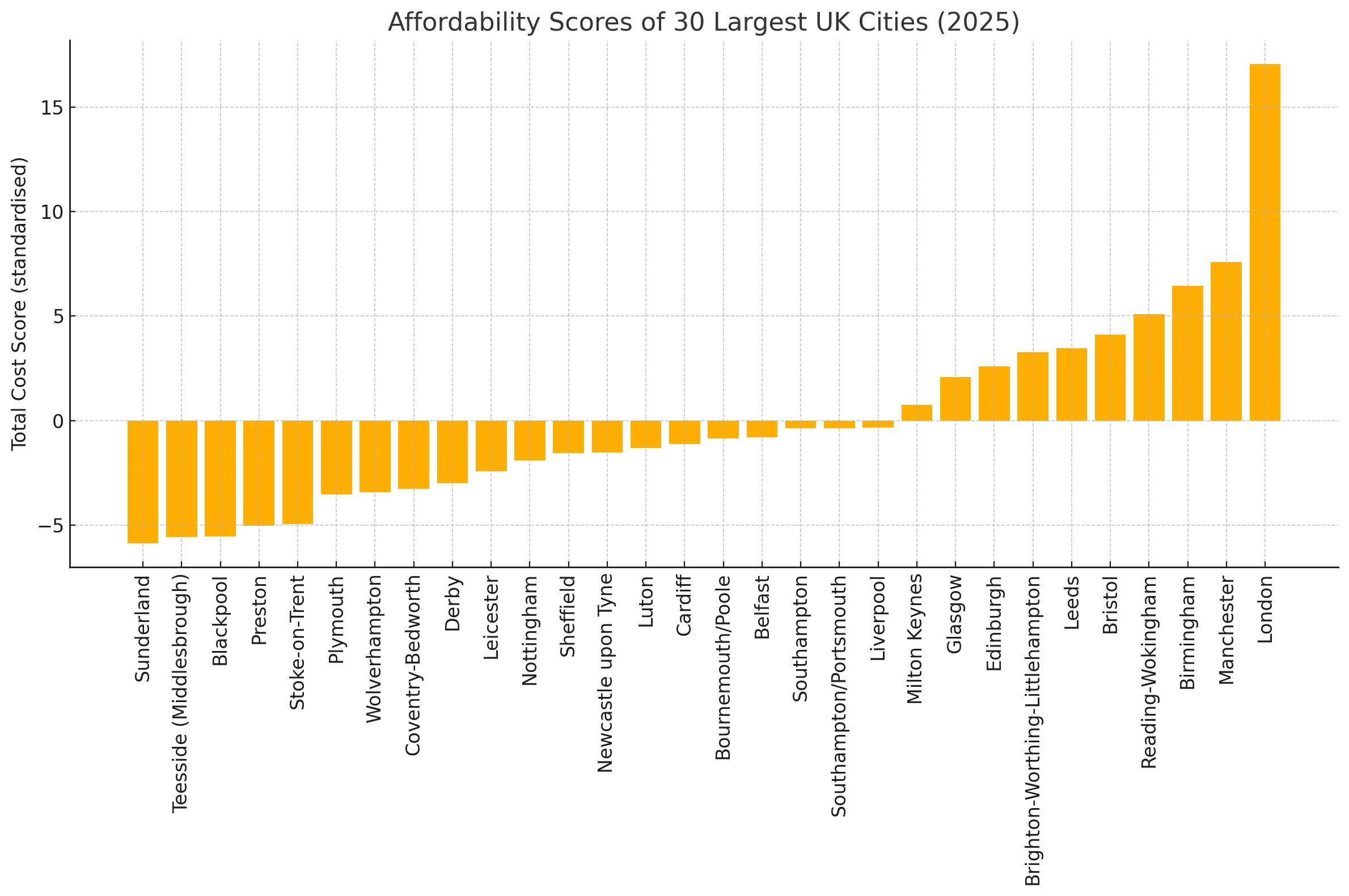

Full data visualisation

Notable findings

While some rankings were predictable (such as London being the least affordable), this study revealed several surprising insights and regional contrasts:

🔄 North–South divide isn’t consistent

Although the North of England dominates the top affordability rankings, some southern cities like Plymouth and Luton performed better than expected, landing within the top 10–15. This reflects targeted regeneration efforts, competitive broadband pricing, and relatively modest commercial rents compared to their South East counterparts.

🏙️ Teesside ranked higher than expected

Teesside (Middlesbrough) came second overall in the affordability index — driven by the lowest office rent and broadband costs in the entire dataset. This makes it a standout destination for cost-sensitive start-ups and satellite offices.

💼 Reading ranks among the costliest

Despite being outside the top-tier metropolitan areas, Reading–Wokingham ranked 27th, ahead of only London, Manchester, and Birmingham. Its proximity to London pushes up both office rents and business rates, making it surprisingly expensive for SMEs.

📉 Brighton and Edinburgh fell into the bottom 10

Both Brighton-Worthing-Littlehampton and Edinburgh ranked lower than expected. High office rental rates and above-average insurance premiums contributed to their costliness — a potential red flag for businesses assuming these are mid-cost regional options.

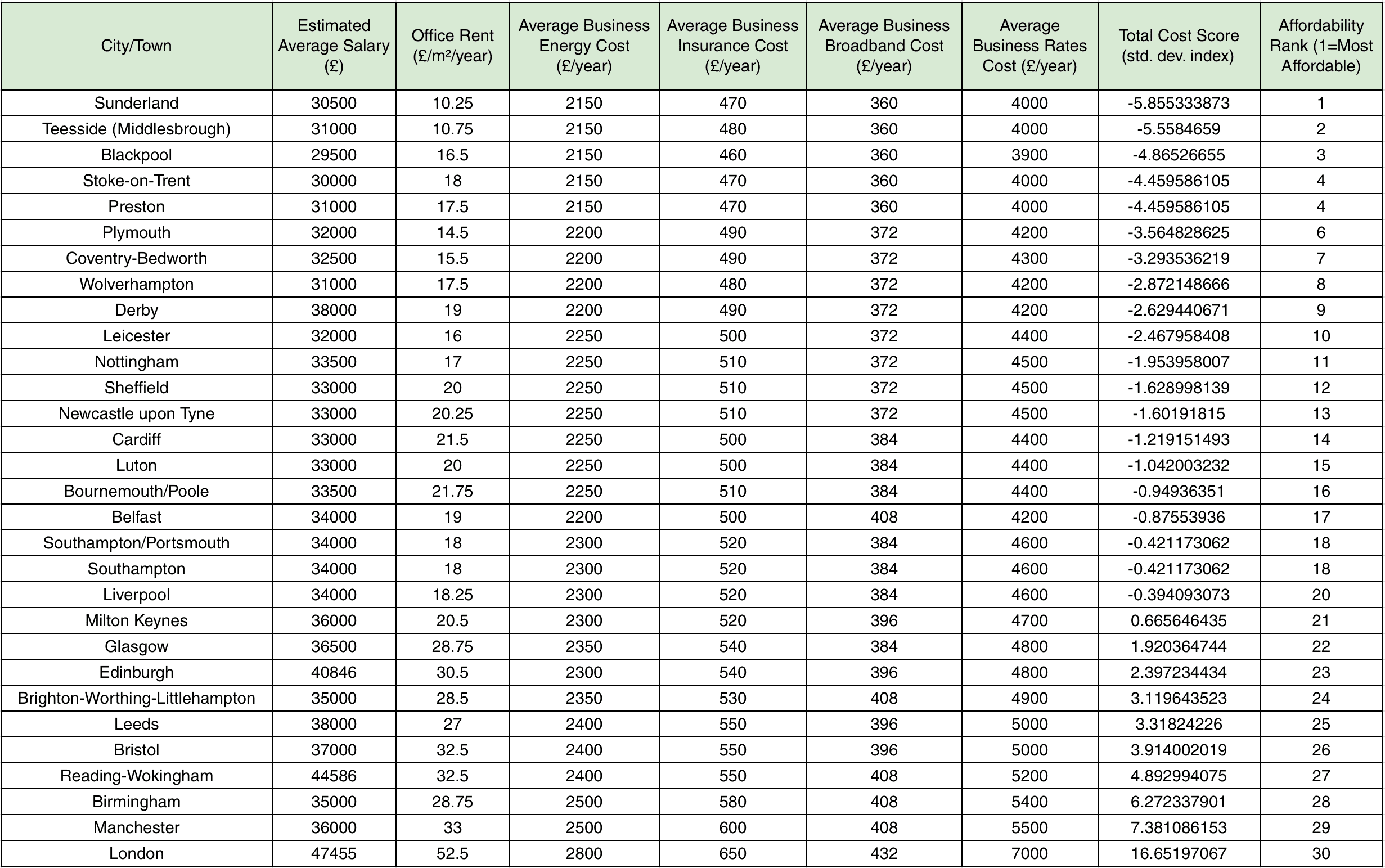

🛡️ Insurance costs are a major differentiator

While not always considered in affordability rankings, business insurance had a notable impact on total cost score. Urban centres like London and Manchester showed significantly higher premiums than similarly sized cities such as Coventry or Derby, reflecting risk-based pricing models.

🧾 Business rates vary more than expected

Although calculated using a consistent multiplier, local rateable values caused dramatic differences. Cities like Blackpool and Sunderland had some of the lowest estimated business rates, offering substantial annual savings over cities like London and Reading.

Responses

We invited local stakeholders and business groups to comment on the performance of their town or city in the research. Here’s what they said.

“Entrepreneurs can maximise their investment and thrive in a supportive environment!”

Babs Murphy, Chief Executive, North & Western Lancashire Chamber of Commerce, said:

“Preston stands out as one of the most affordable places to establish and grow a business, thanks to its competitive local salaries, affordable office rents, and low energy and insurance costs. With reasonably priced broadband and favourable business rates, entrepreneurs can maximise their investment and thrive in a supportive environment!”

The data in full

About the index

The Business Affordability Index was compiled using published sources, SME cost benchmarks, and regional pricing tools from providers including:

- ONS and BEIS data

- Uswitch for Business

- Colliers

- Simply Business

- Commercial property rental databases

Costs reflect a typical small business with under 50 employees occupying standard commercial premises.